Are you a journalist looking for reliable statistics? Or a marketer making a case for retail advertising? Or a digital signage professional wondering whether OOH and retail media networks (RMNs) mean the same thing?

No matter where you're at, you're in the right place. 😉

This state-of-the-industry report from Fugo covers all things retail media growth, including the numbers and statistics behind its rapid-fire. It looks at how big the market has become, what’s driving all that revenue, and how its definitions and spending categories are evolving — especially with DOOH and in-store digital screens.

We'll cover:

- Retail media’s global and regional growth rates

- The scale of investment by major retailers

- The overlap between retail media, DOOH, and in-store digital activation

- And other related digital signage statistics

Market Growth and Size

Retail media has moved from a niche advertising channel to one of the most dominant forces in global marketing spend. It's even outpaced social media’s growth curve: according to Insider Intelligence forecasts, retail media will overtake social media networks in just two to three years (2028).

But just how big is retail media really?

Let's take a closer look:

- Retail media is now a top-three advertising channel alongside search and social. [Source: EMARKETER's Retail Media Forecast Update H1 2025]

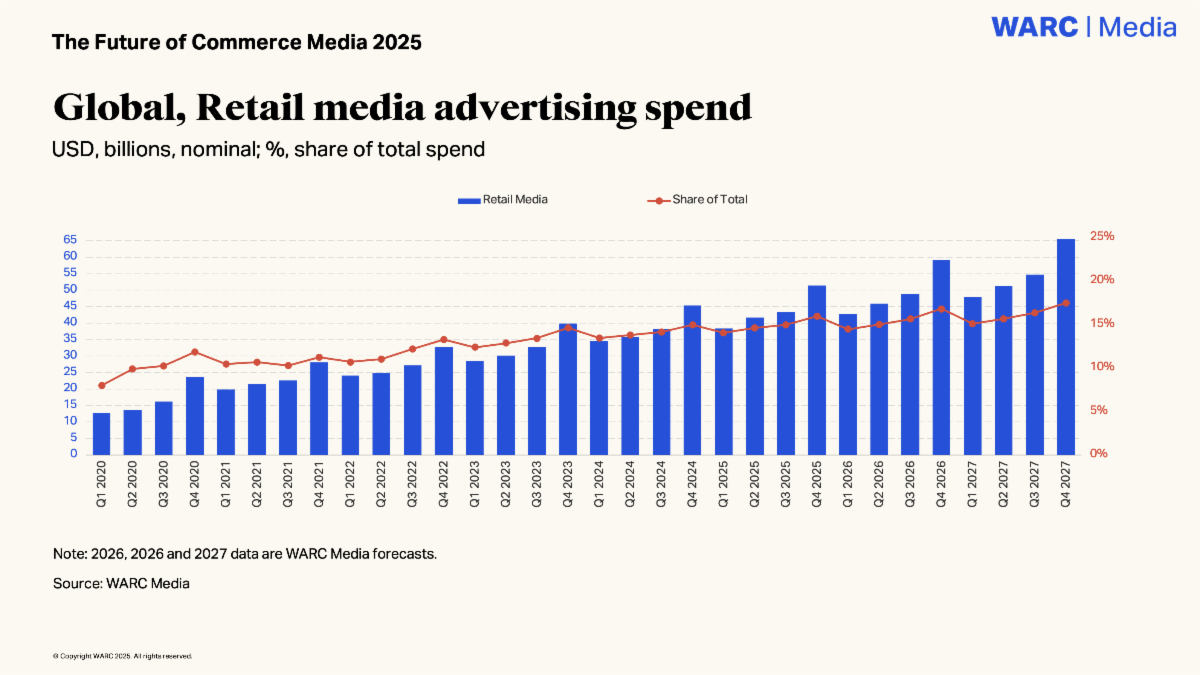

- Retail media spend grew 17.6% YoY, reaching 15.4% of global digital ad spend in 2025. Reports project continued double-digit growth through 2026, fueled by first-party data and closed-loop attribution. [Source: EMARKETER's Retail Media Forecast Update H1 2025]

- Global retail media ad spend is expected to reach $163.2 billion by 2027, up from $122 billion in 2024. [Source: GroupM's “This Year, Next Year” Global Mid-Year Forecast 2024]

- By 2028, retail media is forecasted to account for one-quarter (25%) of all digital ad spending globally. [Source: EMARKETER Research]

- Ad spend on off-site retail media in the US is forecasted to grow 27.1%, in 2025, reaching a total of $13.52 billion compared to $10.64 billion in 2024. [Source: EMARKETER Research]

- Nearly 80% of major retailers now have a retail media network. [Source: Skai's State of Retail Media 2024]

- Most organizations work with six retail media networks on average, although that number is expected to increase to 11 by 2026. [Source: Skai]

- The current market size of retail media was ~$140 billion globally in 2024. The 2026 projection is ~$165 billion. [Source: EMARKETER's Retail Media Forecast Update H1 2025]

Keep in mind that growth is still broad-based. For example:

- US: Still ~60% of spend, but slowing slightly as Europe and APAC accelerate.

- Europe: Strong momentum in grocery and CPG-driven RMNs, according to Carrefour and Tesco Media & Insight.

- APAC: Rapid emergence of retail media spending on Alibaba, JD Media, and Rakuten Advertising.

What’s Fueling Retail Media Growth In 2026?

There's no question retail media ad spending is skyrocketing — largely due to three specific advantages. According to IAB Europe’s Retail Media Measurement Standards 2024 (pp. 3 to 6), it mostly boils down to:

- Retailers’ first-party data advantage. This is working wonders in a post-cookie world where marketing campaigns may struggle to reach consumers.

- Increased standardization in measurement and attribution. Retail media offers something called "closed loop measurement/attribution," which directly ties spending to sales so you can prove (not just estimate) your ROI. This also helps with enabling larger cross-platform budgets.

- Multiple formats depending on your needs. There's on-site, such as digital displays and in-store digital placements, and off-site, such as video ads and CTV experiences.

So... how much are these factors fueling retail media growth?

Let's chart out the specifics below:

- Experiential activations and immersive brand zones are driving incremental spend inside stores. [Source: WARC’s “Rise of Experiential Retail Media” (2024)]

- Retail media is shifting from ad placement to experience design by blending brand storytelling with shopper data. [Source: WARC’s “Rise of Experiential Retail Media” (2024)]

- Retail media is 50% more effective than social media networks at getting customers to take action after reading or hearing a message. [Source: PubMatic's "How To Make Retail Media Work For You"]

- The three biggest challenges in adopting retail media are scale, targeting, and measurement. [Source: TransUnion's 2025 Annual Trends Study]

- Critical factors that may cause marketers to invest less in retail media include:

- Difficulty proving investment incrementality (36%)

- Lower ROI compared to other advertising channels (32%)

- Analytics and reporting limitations (29%)

- Retailer control/walled garden environment (25%)

- Rising costs of retail media (24%)

- Limited data (22%)

- Increasing prevalence of private label products at retailers (19%)

- Ad fatigue experienced by our audience (19%)

- Internal organizational structure limiting effectiveness (18%)

- Lack of standardization across retailers (17%)

- Newness, lacking best practices for investment maximization (16%)

- Lack of retail media expertise internally (13%)

- Poor or inconsistent content (12%)

- Supply chain and retailer fulfillment constraints (12%)

- Increased D2C sales, less retailer reliance (11%)

[Source: Skai and Path to Purchase Institute 2025 State of Retail Media Report]

Key Players in the Retail Media Network Ecosystem

You're likely familiar with the three biggest retail media networks: Amazon, Walmart, and Target. But there are hundreds of other retail media networks worldwide — exactly 277 as of November 2025.

Here are a few other retail media network stats:

- Amazon Ads made roughly $47B in ad revenue in 2023, and is expected to reach $56 B in 2025.

- Amazon Ads remains the largest retail media network in the US, maintaining a roughly 75% share. [Source: eMarketer 2025]

- Amazon continues to dominate retail media, maintaining 15% year-on-year growth through full-funnel expansion and DSP partnerships. [Source: WARC's The Future of Commerce Media 2025]

- Walmart Connect grossed roughly $4.4B in 2025, a +27% year-over-year increase compared to 2024. Most of this was driven by its new Display API media strategy. [Source: Marketing Dive, 2024 Survey]

- 74% of marketers prefer Walmart's retail media network for running advertising campaigns. This is followed by 61% who prefer Amazon Ads, 55% who prefer Target ads, and 52% who prefer the Kroger Precision Network. [Source: Statistica, 2024]

- Lowes is the least preferred retail media network, with just 9% of advertisers' votes. Other less preferred networks include Best Buy (12%), Home Depot (13%), and Family Dollar (16%). [Source: Statistica, 2024]

- The five biggest retail media networks — Amazon, Walmart, Instacart, Target, and Kroger — represent 90% of the addressable media market for both onsite and offsite placements. [Source: AdWeek]

- Carrefour and Criteo's ongoing partnership has expanded international commerce media across 14 markets. [Source: Carrefour and Criteo]

- Costco has only recently entered the RMN scene, with 74.5 million members along with detailed shopper marketing and behavior trends to better target audiences. (NRF 2025 + Beet.TV 2024).

- 53% of US companies choose retail media networks that don’t carry their products. [Source: Merkle's "Retail Media Research Report" (2023)]

Retail Media Revenue Streams and Unique Advantages

RMN revenue per retailer continues to rise as in-store activations and programmatic retail media scale. Some companies have seen significant ROI — around 154% return for every $1 spent on retail media campaigns — thanks to precision targeting and first-party shopper data.

Here's a closer look at retail media revenue streams:

- 10% to 40% of retail media revenue comes from in-store advertising. [Source: Oliver Wyman]

- Consumer packaged goods (CPG) companies in the US allocate 39% of their advertising spend to retail media budgets. [Source: Oliver Wyman]

- 70% of companies will increase retail media budgets in 2025. [Source: TransUnion's 2025 Annual Trends Study]

- Interactive retail displays, including kiosks, boost customer engagement rates by 50%. This is largely due to provider detailed product information and more personalized customer experiences. [Source: T-ROC]

- 95% of consumers feel either positively or neutrally about retail media ads. [Source: Vistar + MFour Retail Media Research Study]

- 44% of shoppers will make a purchase decision because of a retail media ad. 71% of consumers are more likely to consider brands they see advertised. [Source: Vistar + MFour Retail Media Research Study]

- 58% of shoppers who see retail media ads on front entrance screens will buy the advertised product immediately. [Source: Vistar + MFour Retail Media Research Study]

- 31% of shoppers who see in-aisle ads will redeem a coupon or discount code. [Source: Vistar + MFour Retail Media Research Study]

- Retail media lets you show targeted ads to potential customers — which is exactly what they want. 74% of consumers want ads that match the content they're watching. [Source: IAS]

- Retail ads influence customer perception, sentiment, and brand visibility more than any other category. When placed alongside content seen as positive or neutral, favorability scores are 441% higher, receptivity scores are 54% higher, and memorability is 41% higher compared to content seen as negative. [Source: IAS]

- Retail media advertising can support margins up to 90%. [Source: HBR.org]

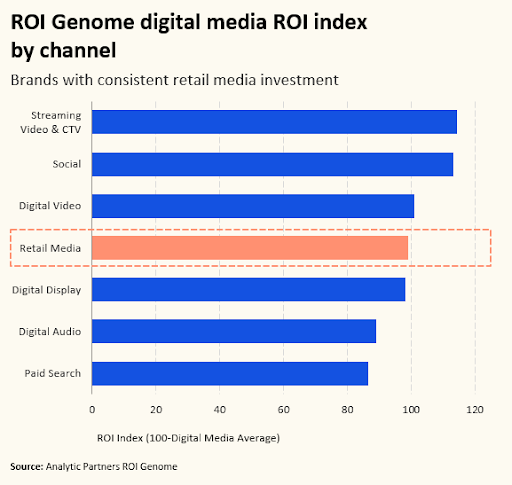

- 80% of marketers say retail media is as effective or more effective than other digital advertising channels. [Source: TransUnion's 2025 Annual Trends Study]

The In-Store Shift: How Retail Media is Meeting OOH

The more retail media matures, the more it outgrows good ol' fashioned ecommerce pages and app banners. Its next big frontier is in-store digital screens — a physical touchpoint where shoppers still make most of their buying decisions.

Now, retail media and OOH are still two separate things. But there's still enough crossover to start creating hybrid networks. Case in point: retailers selling their in-store display inventory through programmatic or data-driven systems.

Here's a closer look at how OOH has become intertwinedout of with the retail media landscape:

- Combining in-store advertising and targeted ads can quickly engage consumers and lead to rapid growth [Source: Quimby Digital]. One case study shows that using CTV prospecting, precise targeting on social media, and video ads can lead to:42% higher add-to-cart ratios24% higher conversion rate18% higher foot traffic15% higher MER20% higher new-to-brand customers

- Retail media’s physical expansion aligns with the boom in DOOH screens at point of purchase, where 85% of grocery visits still occur. This is referred to as "the bridge between physical stores and digital commerce." [Source: GroupM's The Year Ahead in OOH, 2025].

- Retail media and OOH are converging around in-store digital screens, where 85% of shoppers still visit in person. [Source: GroupM’s “Year Ahead in OOH 2025]

- 55.8% of global marketers plan to increase spend on off-site retail media ads. [Source: EMARKETER and TripleLift Survey, December 2023]

- Even though 80% of consumer spending is in-store, 90% of retail media advertising is online. [Source: EMARKETER Forecast, November 2024]

Emerging Trends to Watch for 2026: The Future of Retail Media

If 2025 was the year retail media found its footing, 2026 will be the year it transforms the media mix.

We see many retailers taking advantage of cutting-edge ad technology to customize the buying process, display sponsored products, and ultimately drive sales. Plus, brands are discovering new ways to blend storytelling with measurable sales impact.

Here's a quick glimpse into the future of retail media:

- Programmatic retail media. Retailers will continue extending their media networks into the physical world through digital out-of-home (DOOH). That way, they can serve programmatic ads that change based on local factors. Imagine a sunscreen ad playing when temperatures spike or a raincoat promo triggered by a storm alert. [Source: GroupM, “The Year Ahead in OOH 2025"]

- AI-driven campaign optimization: Artificial intelligence can help analyze customer data in real time to serve up more relevant ads both online and in-store. For example, these could be personalized promotions displayed on in-aisle screens or dynamic loyalty program rewards on checkout displays. This is an easy way to automatically optimize campaigns for higher conversion and engagement. [Source: GroupM, “OOH + AI Retail Integration Summary, 2025”]

- Experiential growth: You can expect to see more immersive in-store brand zones, pop-up experiences, and interactive content. For context, the “experience economy” is projected to hit £146B by 2027 in the UK alone. [Source: GroupM, “The Year Ahead in OOH 2025”]

- Measurement evolution. Post-IAB standardization, common metrics (ROAS, incremental reach) will push more traditional media buyers into RMN ecosystems. Standardizing this type of full-funnel measurement could accelerate future investments by 40%. [Source: Skai and Path to Purchase Institute 2025 State of Retail Media Report]

- New technology shakes up key strategies. This includes checkout screens, endcap signage, and other opportunities that provide brands with new revenue sources [Source: Vistar + MFour Retail Media Research Study]. For example:

- 72% of shoppers approve of parking lot screens

- 68% approve of in-aisle screens

- 64% approve of storefront/entrance screens

Summary and Key Takeaways

So what have we learned from the numbers above?

That retail media growth won't be slowing down anytime soon.

In just a few years, it’s gone from an experiment to a core part of most marketing budgets, right up there with search and social.

And we have a whole lot more to look forward to in 2027. Global ad spend is growing in double digits year over year, and new retail media networks are launching every month. Add in a measurable ROI that outpaces most channels, and it's clear the retail media space is far past its third wave.

So! If you’re still sitting on the sidelines... there's never been a better time to jump in. 🏊

💡 Want more details on retail media? Check out these resources below:

- Retail Media: What It Is and How It's Different From DOOH

- What is Retail Digital Signage?

- OOH with QR Codes

Frequently Asked Questions About Retail Media Growth

Q: How big is the retail media industry?

As of 2025, retail media represents over 15% of global digital ad spend (roughly $122 billion), and is on track to reach $160 billion by 2027. This makes it one of the top three advertising channels worldwide.

Q: What are the 4 PS of retail sales?

The classic 4 Ps of retail sales — Product, Price, Place, and Promotion — have a different twist with retail media. Retailers now use first-party data (Product), dynamic pricing (Price), omnichannel placements (Place), and targeted campaigns (Promotion) to reach shoppers more efficiently;

Q: What is the prediction for retail media?

Experts predict retail media will overtake social media in global ad spend by 2028, becoming a $160+ billion industry. This has been driven by privacy changes, the rise of first-party data, and retailers turning ad space into a key revenue stream.

Q: Does retail media do push ads?

Yes, you might set up retail media ads through apps offering push display advertising. But keep in mind that not all advertisers support all ad formats on all possible RM platforms.